2015 Economy Improving is about the forecast for construction & overall US economy for this year, viewed from the perspective of a custom residential Architect and an authoritative new report by a major construction consulting firm.

Rider Levett Bucknall (RLB), a global construction consulting company, indicated in their Fourth Quarter 2014 USA Construction Cost Report, that they forecast about a 10% gain in new construction in 2015. This is contrasted with about half that for 2014, which means the USA might be enjoying nearly twice the construction activity this year, than it did last year.

Residential construction increases are indicated as a significant part of this trend, according to the report, including construction loan investments. The report cites public (highway, bridges, etc) projects to have gentler growth. The projected leaders during 2015 are projects to come from single & multifamily residential sectors, industrial, manufacturing, institutional and commercial efforts.

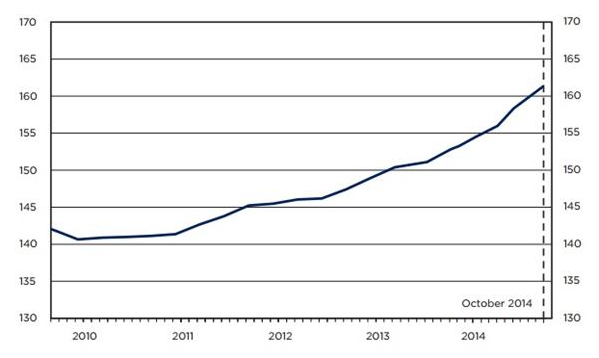

National Construction Cost Index

Part of what’s interesting in the report, is that apparently construction material and labor costs are increasing. This is confirmed by HOME ARCHITECTS ® Senior Staff Architect, Rand Soellner, ArCH, NCARB: “We are seeing material and labor costs increasing in early 2015 already. We have Clients with construction loans in the approval process, that started in late 2014, and the GCs (General Contractors) with whom they have signed agreements are signaling increases in the cost of gravel, concrete, vinyl products and other portions and trades associated with residential construction. This means: construction prices are increasing, certainly at least for houses.”

The RLB report appears to confirm this, as they cite a lack of available skilled labor in the USA. They indicate that when there is demand and a lack of supply, that the goods and services associated with that unfulfilled demand accelerates increased prices in a free market economy like the USA’s. Contributing to the chart’s data (above) was a tracking of costs of construction in a dozen metropolitan areas throughout the USA, during a 4-month period in 2014. Costs of construction increased in varying percentages, from 1.05% to 2.1%.

One of the factors indicated was increased profits allocated to projects, which is no surprise, as housing Contractors have been taking it on the chin since 2008-2010 until recently. It has been a “Buyer’s Market” during the last 4+/- years and that is now changing. Prices for houses have been at historic lows, particularly for resold residences, some at bargain basement prices. However, this is due to the unusual period of “irrational exuberance,” to quote Alan Greenspan, former Fed Chairman during that era, during which housing construction proceeded at a pace exceeding housing demand, as an investment vehicle, in which the builders and investor imagined that the cost of construction would always be exceeded by future sales price. Unfortunately, this turned out to not be true, in the largest recession the USA has known since the Great Depression.

Here’s what that over-building did to the USA housing market: it resulted in a huge inventory of houses sitting there on the market, begging to be bought. And not enough interested people to buy them. The yearly housing absorption rate was much lower than required for those millions and millions of houses to be sold in a short period of time. Hence, the Buyer’s Market, which has been seriously damaging the housing industry for the last 4+ years. Which means that the Builders during that time period had to cut their margins to the bone to have anyone pay them to build a new residence. Those Builders suffered and so did their employees and material providers and subcontractors, through the trickle-down effect.

Therefore, now that demand is increasing, likely due to the vast glut of EXISTING homes previously built during the Big Boom being finally absorbed, or at least closer to that goal, Contractors and others associated with the construction of NEW houses is starting to raise their prices (along with their profit margins, which have been at historic lows during the last several years).

There may be some residual expectation that the very low prices that existing overbuilt houses have been selling for during the last 4+ will be similar to new custom built housing. This is going to change. People who want a new house, custom built to their property and their desires are going to be paying more. The likelihood is that the longer such consumers wait, the more it will cost, as the revitalizing economy gets “legs” and stands and starts to walk upright again.

Why: there is no pressure on Builders and other associated with unbuilt houses to provide them for less than it costs to build them. However, there has been substantial pressure on people, companies and other institutions that have been holding previously built houses that no one was interested in buying: they long to get rid of their bad investment and move on.

Added information: unemployment rates are down to about 6.1% in the 3rd quarter of 2014, which is typically deemed an acceptable level, and indicative of a healthier economy. From the 4th quarter of 2013 through the 4th quarter of 2014, construction unemployment DECREASED from 11.4% down to 7.0% just a few weeks ago. This signals what appears to be an absorption of skilled labor into the construction work force, hence increasing prices happening NOW. Also, the Dow Jones Industrial Average has been hovering around the historic highs in the 18,000 zone. While that is a wild carnival ride of ups and downs, it seems to indicate a surging economy.

THEREFORE:

BOTTOM LINE: from the perspective of this architectural firm: if you have been thinking about having a new custom house designed and built and you can afford it: consider Doing It Now, before the resurrecting economy increases the pricetag significantly. The US economy is at the beginning of what appears to be an upward market trend, as evidenced by RLBs report. Recognizing where you are at in a fluid economy helps you to understand WHEN to act: before prices spiral out of sight. Knowing this, we all should do what works best for our circumstances. If you can afford to do a new residential project, you might want to engage an Architect now to program and design your new custom house.

Custom House Architect: email: Rand@HomeArchitects.com 828-269-9046 www.HomeArchitects.com

tags: 2015 improving economy, cashiers, lake toxaway, highlands, glenville, sapphire, hendersonville, asheville, sevierville, tennessee, alabama, orlando